Building Value, Enhancing Communities

Welcome to Multifamily Investment Group, where we transform apartment communities into thriving, sustainable environments. With over 50 years of combined real estate experience, our team is dedicated to acquiring, renovating, and managing properties that provide lasting value for our investors and residents alike. Join us in creating better living spaces and prosperous investments.

Our Benefit

Owning Real Estate Is A Keystone Of Wealth. Both Financial Affluence & Emotional Security.

💰

Steady Cash Flow

Multifamily properties generate rental income from multiple units, ensuring a consistent revenue stream. Even if a few units are vacant, income from the other units can cover operational costs and debt obligations, providing greater stability compared to single-family investments.

📈

Scalability and Cost Efficiency

Managing multiple units within a single property is more efficient than overseeing multiple single-family homes in different locations. Shared expenses for maintenance, property management, and utilities can lower the overall cost per unit, making multifamily investments more operationally efficient.

🏢

Wealth Building

These properties tend to increase in value over time, especially in markets with growing rental demand. Investors can also drive forced appreciation by upgrading the property, increasing rents, or improving operational efficiencies, which enhances the property's overall value.

Who We Are

We Aim To Give Money Back To Our Investors And Produce Great Returns

Multifamily Investment Group is a multifamily real estate investment firm with over 50 years of combined real estate experience in acquiring, renovating, and managing high-performing properties. As strategic partners with Brennan Pohle Group, we specialize in identifying opportunities in emerging neighborhoods and transforming them into vibrant communities. With a deep understanding of market trends and a commitment to maximizing investor returns, we strive to deliver both financial success and meaningful, long-term value for the residents and communities we serve.

Comprehensive Due Diligence

Transparent Communication

Tailored Investment Solutions

Maximized ROI Potential

Expertise You Can Trust

50+

Years COMBINED Experience

How It Works

Ready to get started?

Meet the Team of Professionals

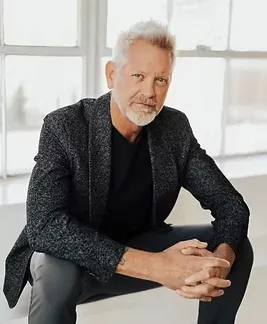

Tony Rodriguez

Principal

Tony is a real estate entrepreneur and principal of the firm with a proven track record, having acquired and operated over 40 single-family homes before transitioning into multifamily investments. He focuses on sourcing and executing value-add opportunities, raising capital, and managing assets to deliver strong, risk-adjusted returns for investors. Known for his resourcefulness and entrepreneurial mindset, Tony is committed to disciplined underwriting, capital preservation, and transparent investor relationships.

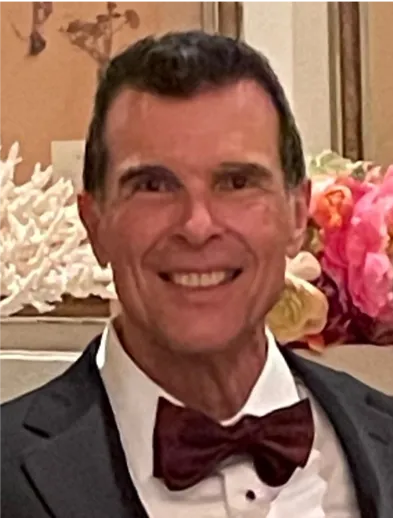

Ryan Hadley

Principal

Ryan has an extensive background in operations and data analysis. His strength in evaluating property performance, identifying operational inefficiencies, and implementing improvements allows him to maximize property value and tenant satisfaction. With a meticulous approach to deal analysis and asset management, Ryan is committed to ensuring optimal performance for both investors and residents.

Strategic Partner

Steve is a distinguished construction executive with a remarkable 45-year track record in multi-family developments. His expertise encompasses the entire spectrum of real estate deals, from entitlements, design and construction management to property stabilization. With a deep understanding of deal structuring and execution, Steve is a trusted authority in the intricate world of multi-family development.

Strategic Partner

Justin Brennan is CEO of The Brennan Pohle Group. With over 11 years of corporate experience in land acquisition, multi-unit development, and value-add apartment rehabilitation & management, The Brennan Pohle Group actively manages end-to-end operations of 10M+ assets at any given time. Building on this success with assets in CA, TX, and MO, OK and AZ.

Eric Weingold

Securities Attorney

Erik P. Weingold is an entrepreneur and corporate securities lawyer with over 20 years experience under his belt. He has been practicing law since 1995, and since 1998 has been drafting PPMs that have been used to raise millions upon millions of dollars for startup companies and small businesses throughout the U.S. [Whiteplains NY.]

Clint Coons

Business Attorney

As one of the founding partners of Anderson Law Group, Clint has grown his legal and tax firm to over 200 employees by assisting real estate investors with creating and implementing solid entity structuring plans. His success in these regards is in large part due to his personal investing experience.

What Clients Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Schneider

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Frequently Asked Questions

What types of investment services do you offer?

We offer three primary services: sourcing properties for direct purchase, providing opportunities to passively invest as a limited partner, or collaborating as a general partner for those seeking a more active leadership role.

How do you determine the best investment?

We analyze numerous properties using advanced AI tools and select those offering the strongest combination of location, cap rate, cash-on-cash return, and overall return on investment.

What is the minimum amount required to start investing with your firm?

Minimum investment requirements differ based on the particular asset in which you are investing.

What types of financing are available for investing in apartment buildings?

Investors can finance apartment purchases through conventional bank loans, government-sponsored programs, private lending sources, or by participating in syndication deals.

What potential risks should investors be aware of when investing in apartment buildings?

Risks may include shifts in the market, tenant turnover, management difficulties, and unforeseen repair expenses. However, thorough due diligence and effective oversight can help reduce these risks.

What factors contribute to the increase in value of apartment buildings?

An apartment building’s value is closely linked to its rental income. Investors can boost its worth by enhancing amenities, increasing rent levels, and keeping occupancy rates high.

What tax advantages do apartment building investments offer?

Investors can take advantage of tax benefits such as depreciation write-offs, deductions on mortgage interest, and the ability to defer capital gains taxes through 1031 exchanges.

Your trusted partner in financial growth and investment success, committed to securing your financial future.